This week, the media in the region reported that Kazakhstan is declining to join the BRICS. Several outlets also reported the possibility of the Netherlands concluding a migration pact with Uzbekistan. They also noted several new investment deals, such as China and Kazakhstan signing 117 agreements valued at $42 billion and Kazatomprom agreeing to supply uranium oxide to China. Other sources reported that Kazakhstan extended the ban on cross-border freight trains with China due to congestion issues. They also reported on the EDB’s last economic growth forecast of 3.4% among its members. Some outlets also picked up on Akmal Saidov, the First Deputy Speaker of the Oliy Majlis, revealing Uzbekistan would not join the EAEU.

21st meeting of the Kazakh-Chinese Coordinating Committee for Cooperation in Industrialization and Investment. Source: Kaz Inform

Diplomatic Events

Kazakhstan has announced that it will not apply for BRICS membership. However, Kazakhstani President Kassym-Jomart Tokayev will attend the BRICS summit in Kazan from October 22-24 (Daryo). Responding to press inquiries, Berik Uali, the presidential press secretary, stated, “Kazakhstan is watching the evolution of BRICS with interest and supports the calls of the leaders of the founding states of the organization to make every effort to build a fair, democratic world order free from the hegemony of any superpowers” (Kazinform). However, he went on to say, “at present and, most likely, in the foreseeable future, Kazakhstan will refrain from submitting an application to BRICS, including taking into account the multi-stage process of considering the membership issue, as well as other issues related to the development prospects of this association.” He also emphasized that President Tokayev remains focused on Kazakhstan’s foreign policy objectives and that Kazakhstan views the UN as the principal global platform of international dialogue. Responding to Kazakhstan’s declining to join BRICS, Dmitry Peskov, the official spokesperson of the Russian President, reiterated that BRICS is not intended to replace the UN but added that he respects Kazakhstan’s decision (Kursiv).

Akmal Saidov, First Deputy Speaker of the Legislative Chamber of Oliy Majlis, confirmed that Uzbekistan would not seek to join military alliances or host foreign military bases (Kun). Regarding the country’s possible future membership of the Eurasian Economic Union (EAEU), he said, “As the head of the parliamentary commission studying Uzbekistan's potential membership in the EAEU, we have thoroughly reviewed over a thousand documents from the organization. Our conclusion is that Uzbekistan is best served by maintaining its observer status.” He noted that Kazakhstan, which joined the EAEU, has seen minimal benefits from its membership. These statements follow earlier reporting on Uzbekistan’s plans to join the Eurasian Development Bank (EDB), a crucial step in the country eventually acceding to the EAEU. However, Saidov emphasized Uzbekistan’s sovereignty in foreign affairs.

Trade

Kazakhstan has imposed an extended ban on cross-border freight trains with China amidst an ongoing congestion crisis (Kazakhstan Newsline). Earlier this year, Kazakhstan banned grain exports through the Dostyk crossing, the main rail crossing between the two countries. However, the situation escalated, and all container trains were banned (Daryo). The ban has since been extended twice and is now in force until the end of November. The authorities noted that the Dostyk crossing has been overwhelmed with 55 trains queuing at the border since late September. The Russian firm Asia Import Group blamed the lack of infrastructure at the border, such as inspection platforms. However, the Chinese logistics company Tiedada noted that the congestion is cyclical and attributed it to the high volume of grain, timber, and timber entering China from Kazakhstan. In light of this congestion, Kazakhstan and China announced the construction of a new $1 billion rail crossing earlier this year (Railway Supply).

Agricultural exports from Tajikistan to Russia have increased by 30% in the first nine months of the year (Asia Plus). However, Nigina Anvari, Deputy Minister of Agriculture of Tajikistan, also noted that imports from Russia increased by 38% compared to the same period last year. She said that agricultural products accounted for 70% of trade between the countries, and the increase was due to a rise in Tajikistan’s exports of vegetables and cotton. So far this year, bilateral trade has amounted to $1.2 billion, an increase of 14.3%. Tajikistan has also begun working with Russia to help improve the efficiency of agricultural production and logistics. Tajikistani producers lack access to international markets and high-quality agricultural technologies, such as high-grade seeds.

Kazatomprom signed a deal worth $2.5 billion to supply uranium oxide to two subsidiaries of the China National Nuclear Corporation (CNNC), CNNC Overseas and China National Uranium Corporation (Kursiv). The CNNC manages China’s nuclear power plants, produces nuclear fuel, and supervises technological development. However, the company’s shareholders must still approve the deal at the next annual shareholders’ meeting in Astana on November 15. In the first six months of the year, the company’s profits increased by 27.4% to $580 million, with total revenue rising by 13.3% to $1.5 billion. Despite sales decreasing by 18%, their output has increased year-on-year.

The demand for freight transport from Uzbekistan to Russia has increased by 64% in the third quarter compared to the same period last year due to Russian importers facing difficulties in making payments to Chinese suppliers, who fear secondary sanctions (UZ Daily). According to Farid Vakhidov, director of the ATI.SU international freight exchange representative office in Uzbekistan, “the payment issues faced by Russian importers for Chinese supplies are forcing them to shift to other markets, including finding suppliers in Uzbekistan.” He noted that this has affected Kazakhstan more than Uzbekistan as Uzbekistani banks are less accommodating regarding re-exporting Chinese goods. In other news related to sanctions, Uzbekistani investors have also reduced their assets in Russian brokerage accounts by 30% to $631 million because of fears of secondary sanctions (Kun). The decline in assets is primarily due to the U.S. sanctions against the Moscow Exchange, the National Clearing Center, and the National Settlement Depository imposed in June of this year.

Energy

Kazakhstan has adopted a new roadmap for the petrochemical industry from 2024 to 2030 (Kursiv). Under the new roadmap, petrochemical production will increase from 357,800 tons in 2023 to 1.8 million tons by 2030 (The Astana Times). The roadmap aims to coordinate the implementation of various projects designed to facilitate this increase in production. It outlines six projects valued at $14.7 billion, which will create 3500 permanent and 16000 temporary jobs. It also includes the construction of additional infrastructure to support the National Industrial Petrochemical Technopark special economic zone. Thus, the roadmap strives to provide the necessary markets, improve human capital, and adopt the appropriate regulatory frameworks to develop the industry.

Economic forecasts

The Eurasian Development Bank (EDB) forecasts GDP growth of 3.4% among its member states this year, 0.3% higher than the global average (Daryo). The EDB revised its forecast upwards thanks to strong economic indicators, increased domestic consumption, structural reforms, budgetary stimulus, and greater export opportunities. Tajikistan’s economy will grow by 8%, Kyrgyzstan’s by 5.5%, and Kazakhstan’s by 5%. The EDB also anticipates that inflation will decrease from 7.2% in 2023 to 5.8% in 2024. It remains highest in Kazakhstan at 8.3%, with increasing inflationary pressures due to rises in housing and utility costs. Finally, they expect interest rates to remain high across the region because of the continued inflationary risks.

Investments

At the 21st meeting of the Kazakhstani-Chinese Coordinating Committee for Cooperation in Industrialization and Investment, Kazakhstan and China signed over 117 commercial documents valued at $42 billion (Kazinform). Deputy Minister of Foreign Affairs of the Republic of Kazakhstan Alibek Kuantyrov and Deputy Chairman of the State Committee for Development and Reforms of the People's Republic of China Zhao Chenxin chaired the meeting. Both sides discussed the implementation of joint projects and the need to expand the list of future investment priorities. Kuantyrov noted that “China occupies one of the leading positions in gross direct investment in the Kazakh economy.” He emphasized that the two countries are pursuing 100 joint investment projects worth around $14.5 billion. He concluded by noting the importance of President Xi Jinping’s visit to Astana for the SCO summit earlier this year.

The 21st meeting of the Kazakh-Chinese Coordinating Committee for Cooperation in Industrialization and Investment. Source: Kaz Inform

On October 14, a ceremony was held to launch nine new projects in the Tashkent region worth around $2 billion (UZA). While investment in Tashkent only amounted to $20 million in 2018, it has since skyrocketed to nearly $1 billion last year. Overall, the region is of great significance for the broader Uzbekistani economy. At the ceremony, Uzbekistani President Shavkat Mirziyoyev noted work has commenced on 91 foreign investment projects valued at around $20 billion and 28 domestic investment projects worth $4.5 billion. A special industrial technopark called “Great Silk Road” will be constructed for $1 billion and will house various pharmaceutical, technical, and engineering enterprises. The new technopark will create roughly 3000 new jobs and generate exports valued at $300 million. A new textile park will also be built in Yuqorichirchiq district for $350 million. Several agricultural and chemical plants will also be built in the Yangiyul and Qibray districts. Six new electricity projects worth around $1.5 billion will be constructed with a total capacity of 800 megawatts. Several leading Chinese companies, including China Energy Overseas Investments and China Datang, will be involved with these energy projects. A new solar plant, two hydroelectric plants, and two new storage systems will be constructed.

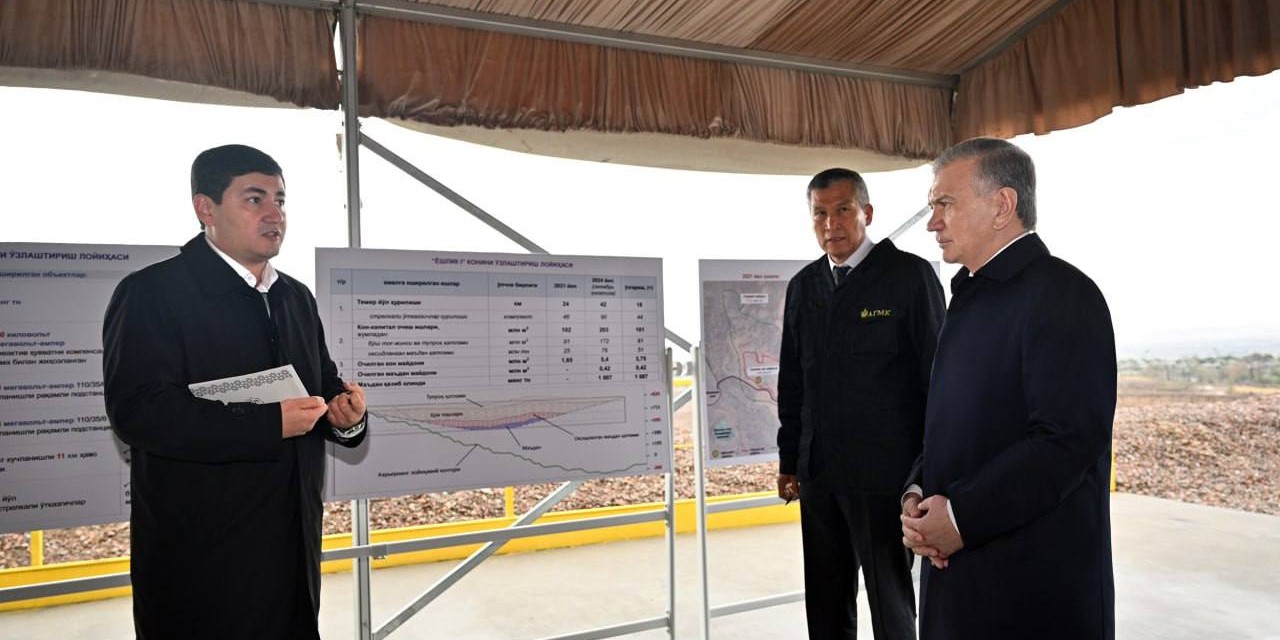

On October 15, Uzbekistani President Shavkat Mirziyoyev reviewed the construction of a new $4.6 billion copper processing plant in Almalyk (AKIpress). The plant is part of the Almalyk Mining and Metallurgical Complex and will significantly enhance Uzbekistan’s metallurgical production when completed in 2028. Following the first phase, the plant will process 60 million tons of ore from the "Yoshlik-1" deposit annually; however, after the second phase, production will rise to 160 million tons yearly.

Uzbekistani President Shavkat Mirziyoyev reviews the construction of the Almalyk processing plant. Source: President.uz

Migration

In light of Germany’s recent agreement with Uzbekistan to send failed Afghan asylum applicants to the country, the Netherlands is examining the possibility of a similar deal (Kun). The Dutch Asylum Minister Marjolein Faber said, “At the moment, the Cabinet is examining the extent to which agreements can be made with Uzbekistan.” Many countries are often reluctant to accept these asylum seekers, especially those with a criminal record. However, last month, Uzbekistan agreed to accept failed asylum seekers from Germany in exchange for aid and the granting of work visas to Uzbekistanis. Nevertheless, Dutch officials say negotiations are still in the early exploratory stage (Eurasianet).